Last Chance To Buy This Walker Lane Gold Stock That Is Under Accumulation at These Prices

Source: Clive Maund 04/21/2025

Technical Analyst Clive Maund shares his thoughts on StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB), explaining why he believes it is an Immediate Strong Buy.

Whilst StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) stock is little changed from when we last looked at it in the middle of December its technical condition has improved greatly against the background of a continued uptrend in gold so that from a timing standpoint the case for buying it is even stronger than it was back then, as we will see when we review its latest stock charts.

Downside for the stock is very limited, whilst upside is relatively unlimited after its long bear market from its early 2021 highs, when it was almost 20 times the current price. The continued decline in the stock price last year was due in part to a succession of financings. Nevertheless, the company has been advancing towards its goals with the acquisition last year of 152 claims at the Cuprite property in Nevada and the purchase of the Hercules Gold Project also in Nevada at a favorable price.

Results from a drill program at the Hercules Gold Project are believed to be pending which could very well act as a catalyst for the stock in the near-term.

Before looking at the stock charts we will first overview the fundamentals of the company with the assistance of pages from its latest investor deck, which was posted in March.

Strikepoint Gold has four properties — the two “flagship” properties in the prolific Walker Lane trend and two other properties in British Columbia.

The map on the following page from the company Deck shows the locations of the two Walker Lane properties in Nevada and also big finds along the trend by other companies, which of course increases the likelihood that Strikepoint’s properties contain significant reserves.

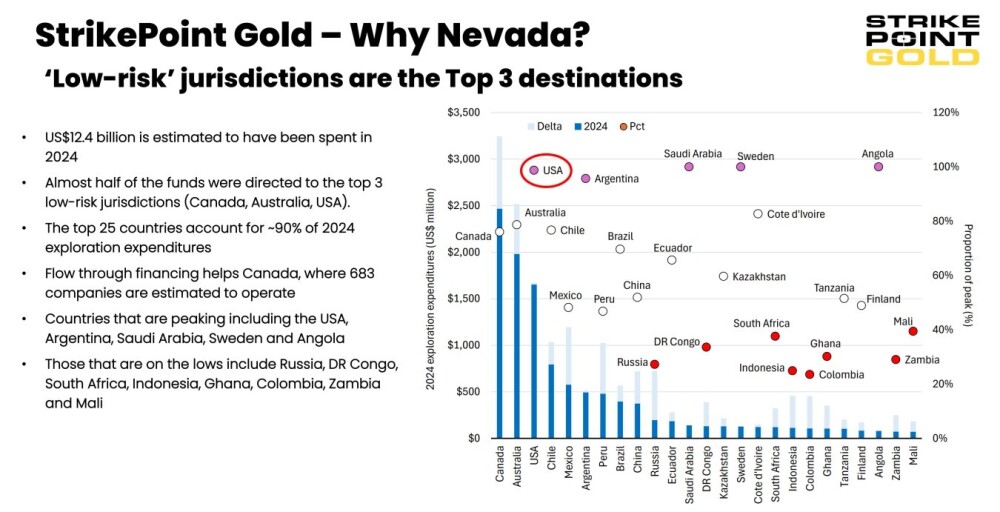

With respect to the companies’ two flagship properties being in Nevada, it is worth pointing out at this juncture that the U.S. is considered to be one of the top mining jurisdictions in the world, as made clear by the graphic on the following page, which is also of more general interest.

Within the U.S., Nevada is considered to be one of the most mining-friendly States.

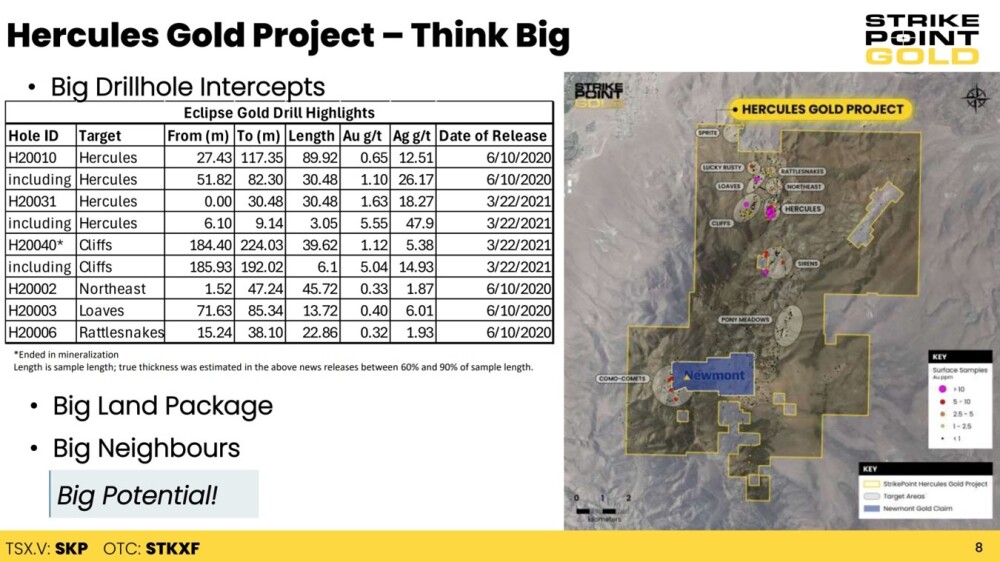

The following page provides some details of the Hercules Property acquired just last year, and it’s important to note that Hercules is not virgin territory — there has been significant exploration there in the past with appreciable quantities of gold having been found. About 300 drill holes were completed and the company has the advantage of having the data from this drilling.

The following table shows past drill intercepts at Hercules and reveals that significant gold grades were encountered.

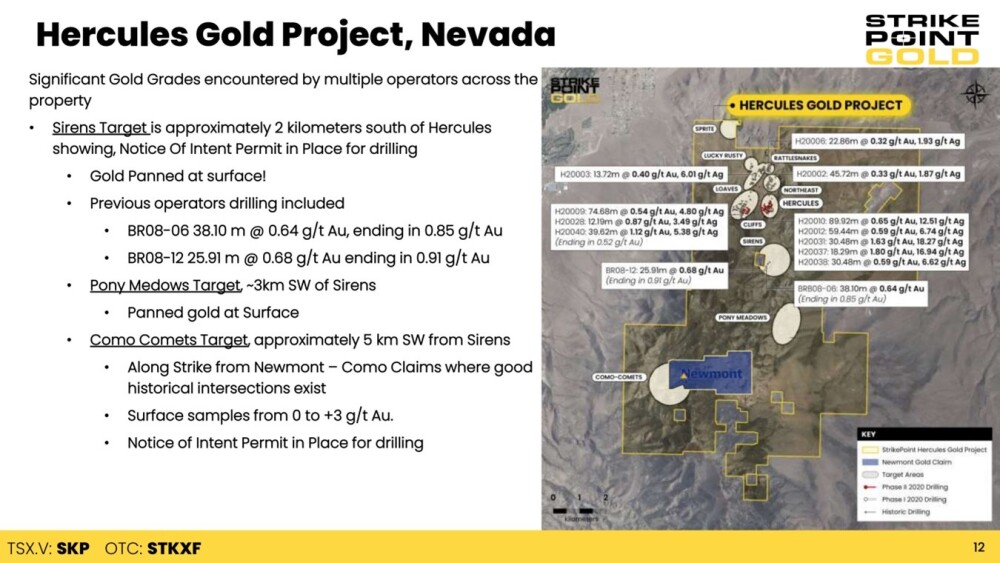

The next page shows the locations and extent of the different targets spanning the Hercules property and highlights of what has already been discovered at some of these targets.

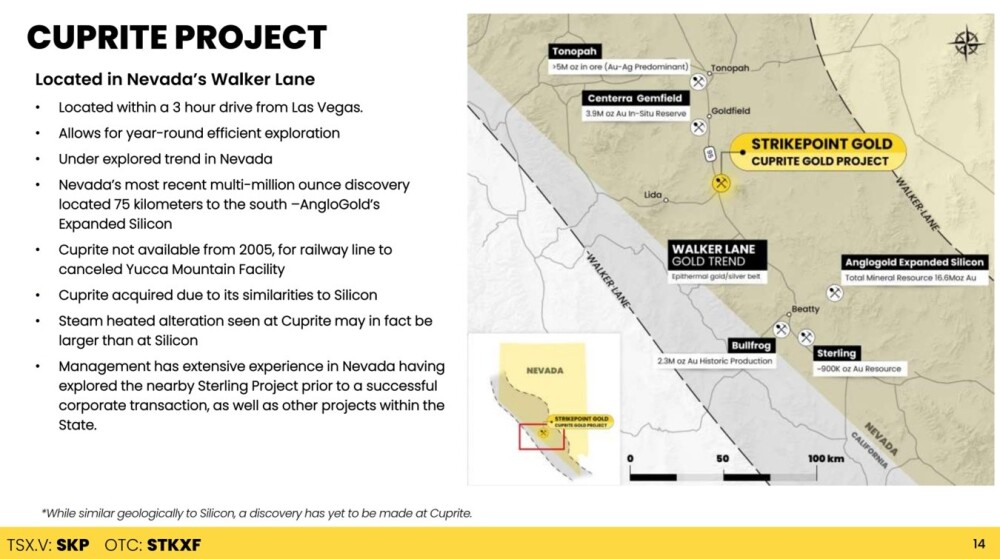

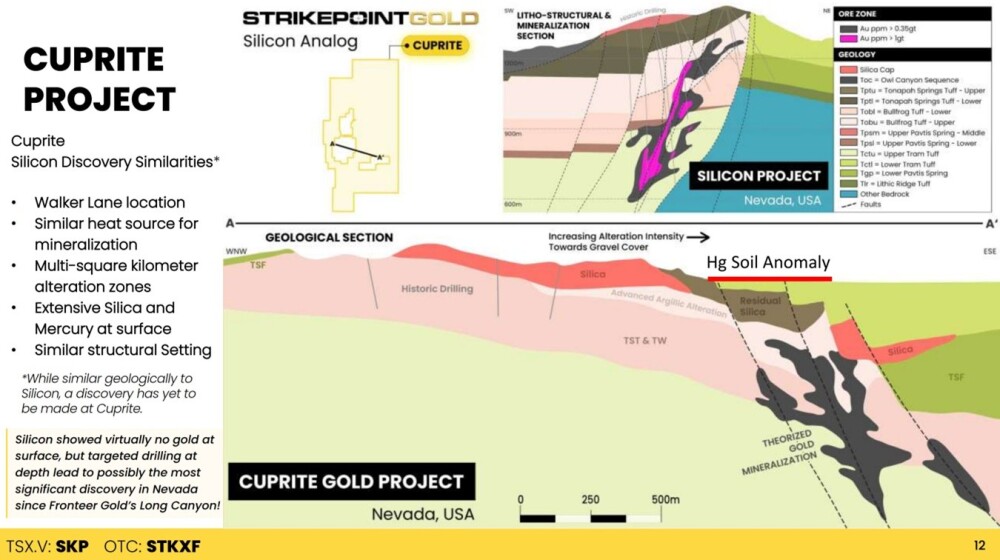

The following page provides an overview of the company’s other Flagship gold exploration property on the Walker Lane trend, the Cuprite Project.

Two key points made on this page are that Cuprite was originally acquired by Strikepoint because of its similarities with Anglogold’s expanded Silicon Project only 75 kilometers to the south where a multi-million ounce discovery was made and the other point is that Cuprite was off-limits for exploration and exploitation up until relatively recently and so by Walker Lane standards is “virgin” territory with a lot of discovery potential.

The following page highlights the similarities between Cuprite and Anglogold’s Silicon major discovery. . .

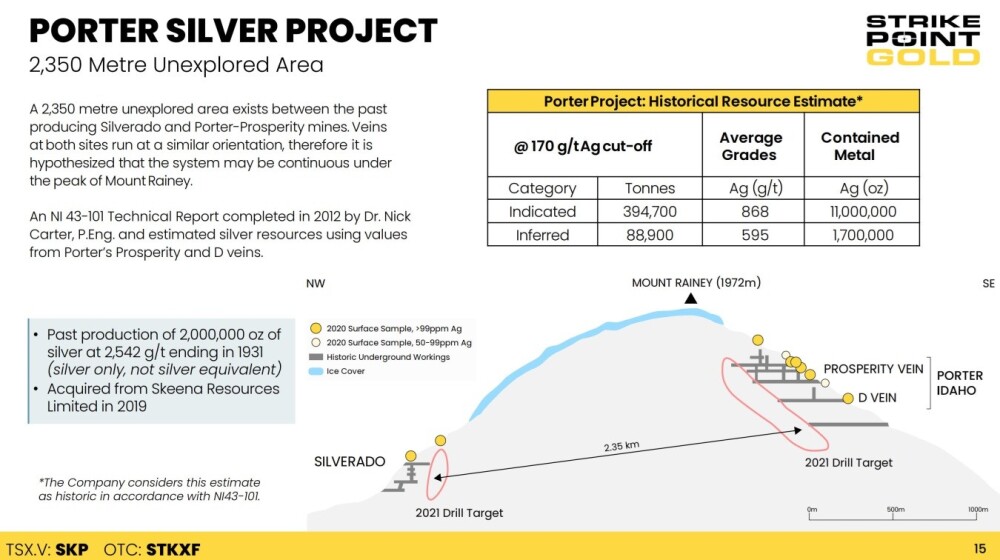

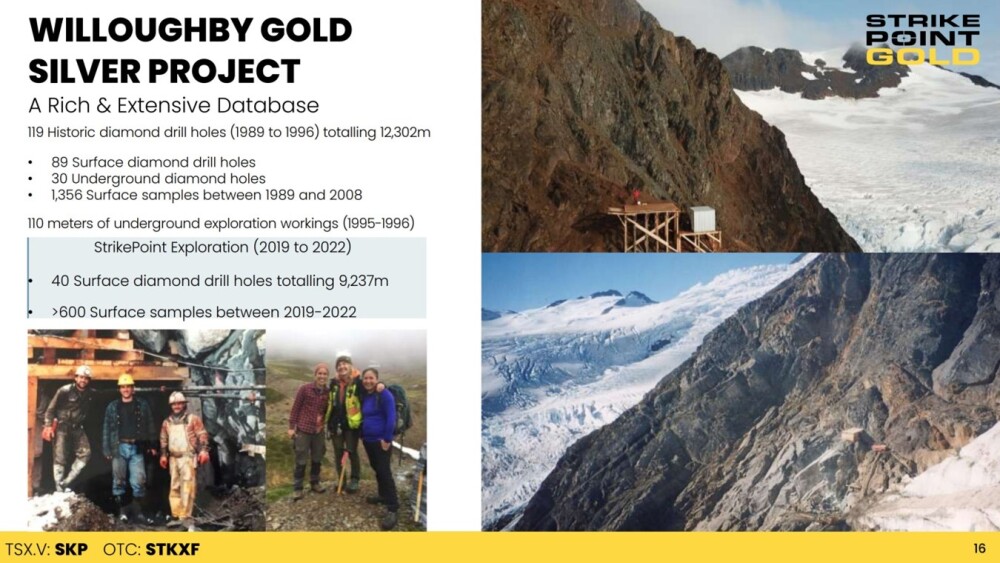

Although the company’s Nevada properties are its “flagship” properties because of their outstanding discovery potential, it is worth bearing in mind that its two other properties in British Columbia’s Golden Triangle also have significant discovery potential.

They are the Porter and Willoughby gold-silver projects.

This page provides some information about the Porter silver project.

A brief overview of the Willoughby gold-silver project is shown below.

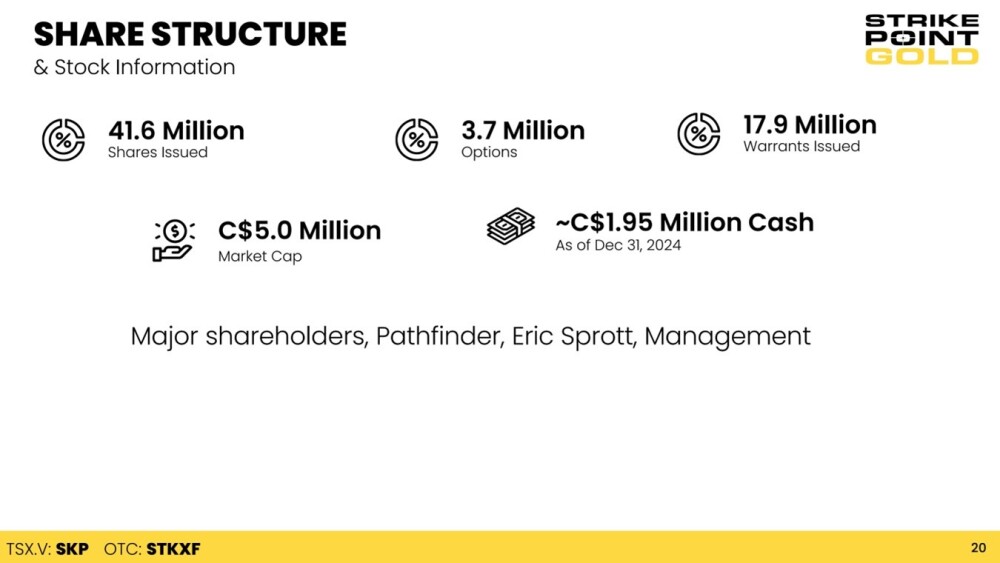

The last page shows the share structure, and on it we see that the company has a reasonable 41.6 million shares in issue, and of these, Eric Sprott and Pathfinder Asset Management have significant holdings.

Now we will review the stock charts for Strikepoint Gold. The time window during which it will be possible to pick up Strikepoint at the current very favorable price is now closing fast for reasons which will become very clear on our charts.

Starting with the long-term 6-year chart, we see that Strikepoint has been in a long and relentless bear market from its start of 2021 spike highs, so for more than four years now. This bear market has brought it down to a low price that is only a little over one-twentieth of its price at its highs.

However, even on this chart, we can see that there has been a significant volume buildup over the past couple of months, which the Accumulation line shown at the top of the chart reveals to have been upside volume because it has been climbing steeply. This is bullish as it shows that someone — or something — has been soaking up the available supply around the current level in a manner that usually leads to a breakout into a new bull market.

On the 6-month chart, we can see much more clearly what has been going on in the recent past. After the price dropped steeply into what is believed to be its final low last Fall, a trading range developed between the support and resistance levels shown, and within it, the price dipped early this month to make a Double Bottom with the November and December lows.

The duration of this trading range has allowed time for the 200-day moving average to drop down so that it is now approaching the price, which is a frequent precursor to a reversal. It is thus interesting to observe that there has been a marked buildup in upside volume since mid-February that has driven the Accumulation line quite steeply higher.

This is certainly a bullish indication and is believed to be due to investors, be they private individuals or perhaps larger parties who understand the value of the company, building a stake ahead of a breakout into a new bull market — and we should keep in mind that as the price of gold continues to ascend, Strikepoint, with its increasingly valuable properties, will become more and more attractive to larger mining companies looking to increase their reserves.

Strikepoint Gold is therefore rated an Immediate Strong Buy for all time horizons. The first target for an advance CA$0.40. The second target is the CA$0.90 area, and the third target is CA$1.20.

Strikepoint Gold’s website.

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) closed for trading at CA$0.145, US$0.1044 on April 18, 2025.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: SKP:TSX.V; STKXF:OTCQB, )

Source: https://www.streetwisereports.com/article/2025/04/21/last-chance-to-buy-this-walker-lane-gold-stock-that-is-under-accumulation-at-these-prices.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.