Silicon, Software, and Shareholder Rewards

There are tech companies that chase trends—and then there’s this company, a juggernaut with one foot in cutting-edge silicon and the other in mission-critical enterprise software.

With exposure to AI, data centers, wireless communications, and now software ecosystems, this technology firm is building an empire around high-margin growth, diversified revenue streams, and powerful shareholder returns.

This isn’t a startup story—it’s a cash-flow machine with proven execution and a rising dividend to match.

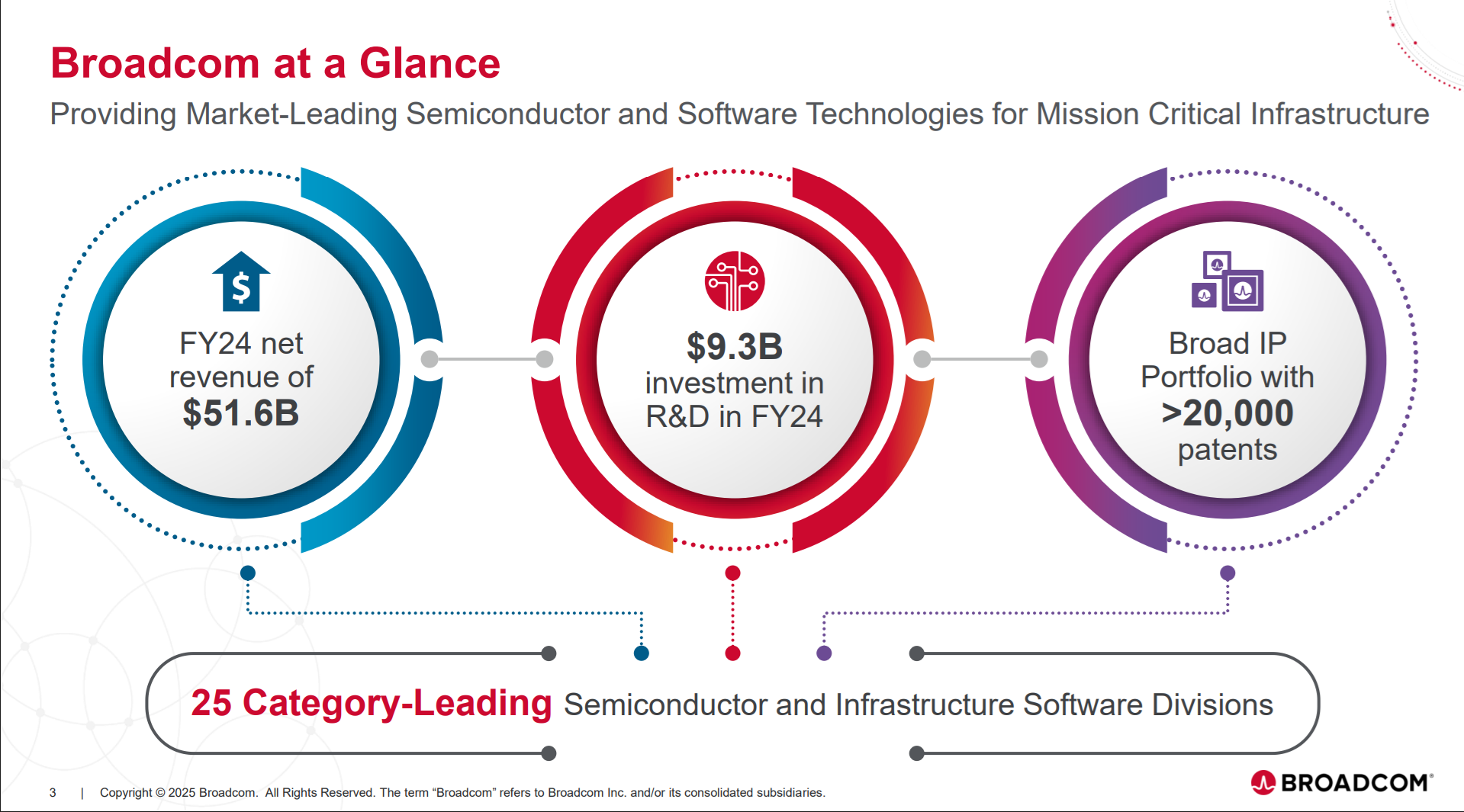

The Architecture Behind Broadcom: Chips and Code Working Together

Broadcom Inc. (AVGO) operates through two synergistic segments:

-

Semiconductor Solutions: These include RF filters, custom chips, wireless connectivity tools, and data center networking hardware. Broadcom is deeply embedded in smartphones, enterprise networks, and hyperscale computing. Its customer base includes titans like Apple and Google.

-

Infrastructure Software: Thanks to strategic acquisitions like CA Technologies and VMware, Broadcom now supports enterprise IT across private/hybrid cloud environments, application security, and mainframe management. This segment delivers recurring, high-margin revenue—a powerful hedge against semiconductor cyclicality.

Together, these two engines create a business that thrives in high-performance computing, wireless infrastructure, and digital enterprise transformation.

What’s Fueling—and Challenging—Broadcom Bull Case: Secular Growth, Smart M&A, and a Network Advantage

Broadcom’s appeal boils down to three big levers: semiconductor leadership, acquisition expertise, and explosive demand for AI infrastructure.

-

The AI semiconductor market is booming, and Broadcom is poised to benefit from demand for network switching and connectivity solutions.

-

Its RF filter business supports nearly every high-end smartphone in production today—a source of durable, recurring income.

-

The acquisition of VMware gives it a dominant position in enterprise software, opening the door to cross-selling and long-term service contracts.

Throw in a history of disciplined capital allocation and shareholder-friendly actions, and you’ve got a tech stock that offers growth with guardrails.

Bear Case: Sky-High Expectations and Tech’s Innovation Risk

Broadcom’s greatest threat? Its own momentum.

The stock has been a longtime high-flyer, raising concerns about valuation. As with all tech firms, a single disruptive innovation could destabilize a core business line.

And while AI demand is hot, new language models like DeepSeek aim to reduce power and chip intensity—which could slow the need for next-gen switching or data-center hardware.

Simply put, Broadcom is in a strong position—but the stakes are high, and the margin for error is thin.

The Real Power Move: Dividends That Grow

Broadcom shows exactly why we don’t believe you must choose between growth and income. You can have both—solid capital gains when markets rally, and dependable dividends when they don’t.

If that mix sounds like your kind of portfolio, you’ll want to check out our Dividend Income for Life Guide. It’s a straightforward, no-fluff playbook for building long-term wealth through dividend growers that actually deliver.

Click here to grab your free copy before your next stock pick.

What’s New? A $10 Billion Vote of Confidence

In April 2025, Broadcom’s board announced a massive $10 billion share buyback program, sending a strong signal about the company’s confidence in its cash flow and long-term strategy.

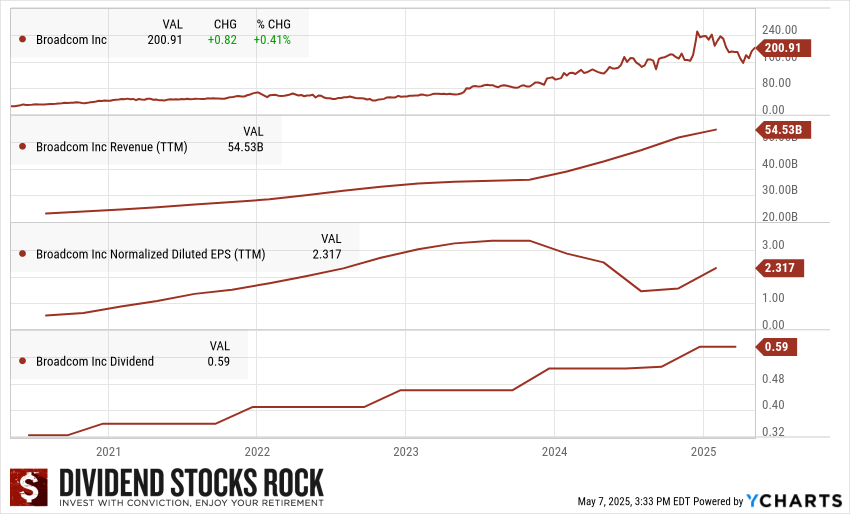

This move follows a volatile period marked by AI growth optimism tempered by uncertainty in the chip cycle. Still, with TTM revenue reaching $54.53B and signs of EPS recovery ($2.317 TTM, rebounding from recent lows), Broadcom is positioning itself to weather short-term swings while reinforcing its core businesses.

In short: the board is backing Broadcom to keep outperforming—with capital, not just words.

Dividend Triangle in Action: A Tech Giant That Pays (and Grows)

Here’s how AVGO stacks up on our Dividend Triangle:

- Revenue: At $54.53B, revenue has grown steadily over the last five years, driven by strong demand across AI, enterprise IT, and smartphone hardware.

- Earnings (EPS): EPS dipped in 2024 but is now rebounding—reaching $2.317 (TTM). This reflects temporary margin pressure, not a breakdown in business fundamentals. Broadcom continues to deliver strong free cash flow that supports capital returns.

- Dividend: The dividend now stands at $0.59/share, rising steadily over the past five years. Despite being a tech name, Broadcom has built a reliable dividend and shows a long-term commitment to income investors.

Final Signal Boost: Cash Flow, Chip Power, and Confidence in Every Cycle

Broadcom is not a moonshot. It’s a fortress—built on a balanced mix of recurring software revenue, semiconductors for the most demanding tech applications, and the kind of capital discipline dividend growth investors crave.

Yes, there’s risk. But Broadcom doesn’t just ride trends—it powers them.

Whether you’re investing for AI upside, defensive software cash flow, or a tech-dividend combo play, Broadcom brings all three. And with a $10B buyback in motion, it’s clear the company is betting big—on itself and on its shareholders.

Looking for Stocks that Pay You and Grow? Start Here.

Broadcom’s the kind of stock we love—growth when the market’s hot, income when it’s not.

If you’re aiming to build a portfolio that cranks out reliable dividends without giving up on long-term upside, our Dividend Income for Life Guide is where you start. It’s packed with tips, strategies, and real-world examples of how to turn dividend growth into financial freedom.

Grab your free copy here, and let’s build a portfolio that works as hard as you do.

The post Silicon, Software, and Shareholder Rewards appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/broadcom-avgo-analysis/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.