Build Your Dividend Portfolio

How should you build your dividend portfolio? How can you ensure your holdings can weather all kinds of markets? What happens if we hit a recession?

Fear is a powerful emotion and not easily dismissed. It’s often the reason for low confidence. A rational response is to seek more information. Your brain asks you to validate your opinions, beliefs, and investment thesis. Unfortunately, the more articles you read, the more people you talk to, and the more analysis you do, the less likely you are to act. Words are fun but meaningless if they don’t prompt action. This is how you suffer from “paralysis by analysis.”

Everyone recognizes himself in at least one of the following statements:

- One of my stocks dropped 30%, I wonder if I should sell.

- I have cash ready, but I everything is overvalued.

- I don’t think adding money to my portfolio is wise right now.

- I’m considering selling 30% of my holdings to protect my capital.

- I’ll wait until things settle down before I invest.

- I’m losing money right now; I don’t like it.

- The market is down today. What if it’s the beginning of the next crash?

- I’m paralyzed in front of my computer; I just can’t click on the buy or sell buttons.

Say no more, and follow a simple technique for selecting the sectors and best dividend stocks to build a dividend portfolio confidently. I have successfully used this technique to build several dividend portfolios for my membership website, Dividend Stocks Rock (DSR).

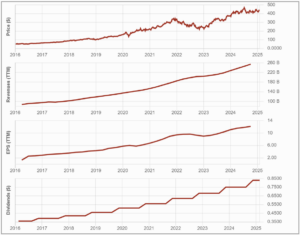

The Dividend Triangle: Your Simple Formula to Find the Best Dividend Growth Stocks

In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica. We lived the adventure of a lifetime. It was a wonderful experience because we had a clear strategy. We knew where we were going and why we were doing it, and we had ways to handle challenging days. The market will keep throwing curve balls; let’s ensure you don’t whiff on them.

At DSR, we also have a clear strategy: We focus on dividend-growth stocks. We handpick companies with a strong dividend triangle and verify that we understand their business models. Since our model is easy to understand and we know why we’re using it, we don’t doubt ourselves.

What is the Dividend Triangle?

It consists of the five-year trend for three simple metrics: Revenues, Earnings per share (EPS), and Dividends. The dividend triangle helps protect your portfolio from the potential storm that inevitably will come. Companies losing market share due to their lack of competitive advantages will see their story unfold through revenue trends. It is very rare to see any business publish growing revenues year after year if they are losing market share.

Revenues

A business isn’t a business without revenues. What’s the difference between a company making increasing revenues and one showing stagnant results? Growth! We look for businesses with multiple growth vectors that will ensure consistent sales increases year after year.

Earnings per share (EPS)

You cannot pay dividends if you don’t earn money. The dividend payment cannot increase indefinitely if earnings don’t grow strongly.

EPS is based on accounting principles (GAAP), which include non-cash charges and irregular items unlikely to recur, such as a product recall. Consequently, EPS is flawed and can be misleading. To make up for this, reviewing the EPS trend over 3, 5, and even 10 years is best. Also, review the Adjusted EPS, which disregards irregular items, thus reflecting more accurately the recurring profit from the company’s operations.

Dividends

Dividend payments are the obvious backbone of any dividend growth investing strategy. But I don’t mind the real dollar amounts or the yield; I focus solely on dividend growth. Dividend growers show confidence in their business model. Increasing the dividend shows that the company has enough money to grow its business, reward shareholders, pay off its financial obligations, and invest in new projects (CAPEX). No responsible management team increases the dividend if they lack the cash to run their business.

There are justifiable reasons for weaker results:, such as the end of a cycle, a change in the business model, or simply the economy slowing down. However, if this persists for several years and management can’t find growth vectors, raise a red flag!

The same logic applies to earnings. If a company cannot generate growing EPS for several years, dividend growth will likely not happen either. Because of EPS’s flaws, it’s good to review cash flow metrics to see what’s going on.

Keep in mind dividends aren’t magic; they’re the result of strong free cash flows, not the cause of good free cash flows.

What happens when companies generate strong free cash flows? They tend to have a rising stock price over the long haul, a reliable dividend growth policy, and make you a more prosperous investor.

Use This Complete Guide to Build Your Recession-Proof Portfolio

Throughout my years as a private banker and helping investors at Dividend Stocks Rock, I have realized that a lack of conviction was the root of all their struggles. Whether it is the fear of losing money or making the wrong choice when buying, a straightforward strategy using the dividend triangle will ease your investment decisions. I have built this complete Recession-Proof Portfolio Workbook, for that matter. Follow its actionable tools to create a long-lasting portfolio to sustain your retirement goals.

Enter your name and email below to get it free in your email.

The Secret: Sector Allocation

To build a rock-solid portfolio, you must now overlook sector allocation. Combined with the dividend triangle, it can create a reliable source of income at retirement. If you were afraid of a recession in early 2020 and put most of your money in consumer staples and gold, you outperformed the market by a wide margin. If you were an oil & gas investor, you no doubt regret making that decision. On the opposite side, the Oil & Gas sector was the place to be after the vaccine news started to spread in the fall of 2020. The energy industry returned from the dead, and all the courageous investors who had invested in that dip were greatly rewarded.

At Dividend Stocks Rock, we use a precise guideline. Nobody should invest over 20% of their money in a single sector unless you are well-diversified in numerous industries. The more you add to past 20%, the more volatile your portfolio may be. When the market drops, it affects all sectors. However, each crisis will be particularly hurtful for a few industries. The problem is that we never know which ones will suffer the most. It could be tech stocks (1999 tech bubble), banks (2008 financial crisis), oil & gas businesses (2015 oil bust, 2020 COVID-19) or entertainment, travel, leisure, and retailers (2020 COVID-19). The key is to hold some of the best companies from each industry sector.

Here’s my view on how each sector can help you build a stress-free retirement portfolio.

Core sectors

Core sectors include companies you should consider first. It doesn’t mean they must all be in your portfolio, but they are less likely to be impacted by a global recession. Each one has its unique characteristics.

Technology

Dividend growers in this sector are usually “old techs” that dominate their industry. They sit on significant cash and cash flows. Retirees ignore them because of their low yields. Interestingly, they went through the COVID-19 pandemic without breaking a sweat. Cash is king during most recessions, and old tech stocks like Microsoft (MSFT), Apple (AAPL), and Broadcom (AVGO) are generating plenty of cash.

The technology sector is best for growth investors but could also offer a haven for income investors.

Financial services

Banks are at the center of our capitalistic system. They can get too greedy (2008 anyone?), but in general, they offer a good source of dividends. You can find great companies among large banks, JP Morgan (JPM) for example, large asset managers, such as BlackRock (BLK), and payment processors Visa (V) and Mastercard (MA), often elements of successful portfolios.

Consumer defensive (or staples)

When we discuss consumer staples, we often describe it as all the products you may find in your house. Those are products you must buy no matter what happens in your life. These companies have built stellar brand portfolios supporting repeat purchases. Repeat purchases lead to constant and predictable cash flows. Therefore, food, beverage and household products could be a great foundation for building a dividend growth portfolio. If you are concerned about the current state of the economy, add some consumer defensive stocks to your portfolio

Procter & Gamble (PG), Coca-Cola (KO), and Costco (COST) don’t need an introduction for most investors, and you may value their stability.

Healthcare

I’m not a huge fan of the healthcare sector because it’s mostly big pharma spending billions in R&D. Their drug pipeline is crucial and consumes most of their cash flow. Maintaining a dividend growth policy while developing new medicines makes it hard. Nonetheless, you can find solid dividend growers in this category (Johnson & Johnson (JNJ), AbbVie (ABBV)).

You can also find great businesses in the medical device sub-sector, such as Lemaitre Vascular (LMAT) and Abbott Laboratories (ABT). Healthcare businesses have one thing in common: our health remains crucial no matter how the recession hits. Therefore, recessions should be less harsh on them.

Learn about Sectors’ Industries, Strengths, Weaknesses, Roles, and Favorite Picks

There’s nothing like knowing what you own and why you own it. To pick the right assets for you, you must understand the role each sector plays in your portfolio.

You don’t need to read thousands of pages about technical analysis to know what a sector is about. In this workbook, I share each sector’s industries, its greatest strengths and weaknesses, how to get the best of it, and my favorite picks.

It’s a fantastic guide to select your sectors.

For a more in-depth look at industries and much more, download our Recession-Proof Portfolio Workbook.

Growth sectors

While you can find growing businesses in all sectors, some industries offer you stronger growth potential. Many investors put the technology sector in this category, but I prefer to classify it as core assets.

Consumer cyclical (or discretionary)

The name says it all; when the economy booms, consumer cyclicals follow. We can look to the automobile industry where you find auto parts makers such as Genuine Parts (GPC)). Classic restaurant chains such as McDonald’s (MCD), Starbucks (SBUX) also do well when consumers are hungry. Sporting goods and apparel like Nike (NKE), and home improvement companies like Home Depot (HD) can be of interest. This is a rare sector where you can go over 20% and still have broad diversification. The buying process for a new car isn’t the same as for a burger or a t-shirt.

Being cyclical, they can hurt during economic slowdowns and recessions and when inflation and rising interest rates squeeze consumers, leaving them with less discretionary spending room.

Industrials

The second growth sector is industrials. Like consumer cyclicals, the industrial sector offers a wide variety of completely unrelated industries. Since each industry follows a different cycle, you can often pick stocks at a cheap price while clouds are gathering. A classic example is railroads. Companies such as Union Pacific (UNP) and CSX (CSX) were selling at a great discount during the 2015-2016 oil bust. You’ll also find long-term dividend growers like Lockheed Martin (LMT) and Automatic Data Processing (ADP), which offer great opportunities occasionally. You just must be patient and you’ll be able to buy several great businesses during their downcycle.

Income sectors

Ah! The section you’ve been waiting for… every retiree’s dream: live off your dividends without touching your capital!

This has become a difficult strategy to achieve, as many high-yielding stocks get crushed during recessions. You put your entire retirement in danger by chasing yields (we’ll discuss this issue at the end of this book). When a company cuts its dividend, you lose your source of revenue and often suffer a capital loss. Fortunately, some sectors are offering decent yields and peace of mind

REITs

REITs are a popular investment vehicle, offering generous dividends and portfolio stability. They own or finance income-producing properties such as apartments, office buildings, and malls, distributing at least 90% of taxable income to shareholders. Investors benefit from high yields, inflation protection, and diversification.

However, REITs face risks, including debt reliance, economic downturns, and sector shifts that may impact dividends. Key metrics like Funds from Operations (FFO) and Loan-to-Value (LTV) help assess financial health.

Since you can achieve great diversification within the various REIT sub-sectors (Industrial, Residential, Commercial, etc.), this is a sector where you can easily invest 30% of your portfolio if it fits with your goals. This sounds like a sound plan for income-seeking investors.

Utilities

Another haven for investors during crises is the utilities sector. We need power and water. I lean towards clean energy utilities such as NextEra Energy (NEE) and Xcel Energy (XEL). Since they carry a lot of debt due to their sizeable capital expenditures, utilities benefit from low interest rates, and feel it when they rise. Don’t expect much growth as the economy slows down, but the dividends should remain safe.

Telecoms & communications

When you think of the communications services sector, you may automatically think of AT&T (T) and Verizon (VZ). Those companies are praised by income-seeking investors as they pay high yields and have shown consistent dividend growth. They suffer from poor revenue growth and higher interest charges due to their capital-intensive business model. While they have a high dividend yield, their dividend trend isn’t as strong as it used to be. Until they find growth vectors and pay down their debt, proceed cautiously; monitor your holdings quarterly.

But there is more than just the wireless industry here. We are talking about all types of content, from advertising to cable and now streaming to internet content. This is how “tech companies” like Meta (META) and Alphabet (GOOG) have pushed this sector on a more bullish trend.

Sectors to ignore

I’ll get straight to the point: I dislike the energy and basic materials sectors because they depend on commodity prices to be profitable. Their cash flow is often volatile since they cannot control those prices. This makes them marginal dividend growers. I understand you can occasionally make an excellent investment in those sectors, but more people get burnt than they get rich. It’s a risk I’m not willing to take.

How to Invest with Confidence — Even at All-Time High Prices

Everything seems overvalued now. Investing without knowing if you’re paying too much for a stock is stressful. This might give you the impression you won’t reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook that gives you the actionable tools to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and directly address your buy/sell questions.

- Build your dividend income portfolio and manage it through difficult times.

- Enjoy your retirement.

Download the workbook now!

The post Build Your Dividend Portfolio appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/build-your-dividend-portfolio/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.