Respect & Clarity: China Opens Door For Reengaging Trump In Trade Talks

Nasdaq 100 and S&P 500 e-mini futures trimmed overnight losses after China reportedly laid out a set of preconditions for resuming trade talks with President Trump and his administration, Bloomberg reported, citing a source familiar with Beijing’s internal deliberations.

According to the source:

-

Demand for Respect: China wants a more respectful tone from the U.S., particularly reducing disparaging remarks from U.S. cabinet members. Beijing was especially angered by Vice President JD Vance’s recent “Chinese peasants” comment. Chinese Foreign Ministry spokesman called Vance’s remarks “ignorant and disrespectful.”

-

Unified U.S. Messaging: Chinese officials are confused by conflicting signals from Washington. While Trump’s tone on Chinese President Xi Jinping has been moderate, hawkish comments from other high-ranking White House officials have conflicted. Without a clear and consistent U.S. position, China sees little value in engagement.

-

Point Person: Beijing wants the Trump administration to designate a point person to oversee trade talks.

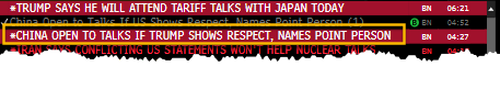

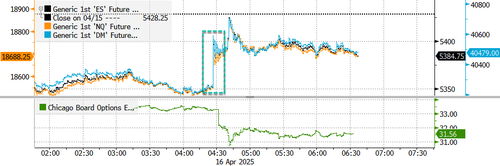

News of the preconditions crossed the Bloomberg wires at 0427 ET.

This sent the U.S. main equity index futures surging, trimming earlier losses from European and Asian sessions.

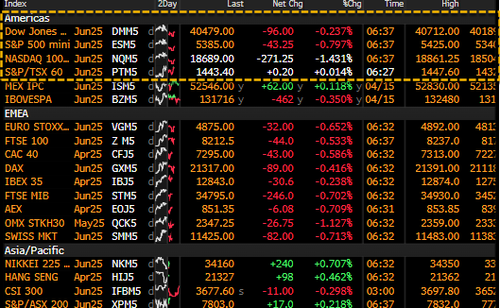

As of 0630 ET, Nasdaq futures are still down 1.5%, while S&P 500 futures are down around 1%.

Commenting on the Bloomberg report, Gary Ng, senior economist at Natixis, said these developments of potential trade talks between the U.S. and China might fuel more risk-on sentiment:

“The impact on the dollar will still be mixed for now, but there will be more inflows into equities, both in China and the US.”

Ng emphasized that this is not a U-turn in strategy, noting China had already signaled its openness to talks in a white paper published on April 9. However, he cautioned that a deal remains uncertain given the wide range of unresolved issues and the deepening economic and geopolitical rivalry between the two economic superpowers.

Goldman analyst Rich Privorotsky commented on the latest trade developments and markets:

China IP and retail sales strong overnight…largely ignored as markets lower on the back of U.S. restrictions on NVDA chip exports to China. This follow’s yday’s announcement of China halting the import of Boeing plans. Seems like the conflict between the two countries continues to escalate without a clear off ramp. “US President Donald Trump is willing to strike a trading deal with China, but the latter should reach out first” (RTRS) The upshot “China has appointed a new top trade negotiator amid the tariff war with the U.S.” Bar feels low for some face saving exercise to bring both sides to the table (tricky part is who makes the first move). In a sense that could be a short term positive catalyst from here but even if tariffs are reduced they are likely to persist on China at some elevated level. The implications on U.S. consumers, global trade and growth remain impaired.

So technicals we’re largely supportive yday and we for the most part ignored those trade headlines including news that European/U.S. trade negotiations had made little progress and EU trade delegation came back expecting no change to U.S. tariff policy. Hard to read too deep with another ~85 days left in trade negotiations… did we really think we’d have a breakthrough on day 5?

Despite supportive technicals those pesky fundamentals continue to point a pretty downbeat picture. Second European bellwether to miss this morning ASML: orders seemingly well below consensus and Q2 guidance seems light (downside compounded by NVDA news). UAL (forgive the dad joke) gave guidance wide enough for jumbo jet to fly between “United Airlines shared two financial outlooks for its full-year earnings because it believes it is “impossible to predict” how the economy will shape up during the rest of the year. The first outlook, which is the same range it previously shared in January, is based on a stable economic scenario where books remain weaker but stable. If the U.S. enters a recession, United is modeling an incremental five-point reduction to total operating revenue, further capacity reductions and a lower adjusted earnings range. “A single consensus no longer exists, and therefore the Company’s expectation has become bimodal,” United said. If corporate are experiencing this level of uncertainty its hard to see how orders/activity/capex/any form of forward planning in the economy isn’t materially slowing (see side-note).

Macro dinner last night think we all acknowledge that the market could continue to squeeze up in the short-term. Vol compression, holiday, lack of incremental trade bad news (Can we really go higher than this: “China now faces up to a 245% tariff on imports to the United States as a result of its retaliatory actions.”

The fate of the global economy and financial markets hinges on a trade deal. The latest effective rate of 145% on Chinese goods entering the U.S. and 125% on U.S. goods entering China have already created ructions in global trade routes (read here and here) that only suggest macroeconomic headwinds are incoming in both China and the U.S.

Tyler Durden Wed, 04/16/2025 – 07:20

Source: https://freedombunker.com/2025/04/16/respect-clarity-china-opens-door-for-reengaging-trump-in-trade-talks/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.