Who Paid for That? The Problem with Analyzing Federal Grants

As the second Trump administration and its Department of Government Efficiency (DOGE) hit the ground running, activists both inside and outside the administration are highlighting government spending for DOGE to recommend eliminating. (You can see Capital Research Center’s offerings at The DOGE Files.)

But some of the commentary hasn’t been quite right, and many of the errors are related to misunderstanding about donor-advised funds (DAFs) and fiscal sponsorships. This is how you arrive at the unsubstantiated claim, endorsed by DOGE leader Elon Musk, that the U.S. Agency for International Development (USAID) was indirectly funding Bill Kristol’s left-of-center advocacy network. USAID is the foreign-aid agency the Trump administration has targeted for fundamental restructuring.

To help those interested in DOGE’s activities understand government grantmaking better, let’s talk through how donor-advised funds and fiscal sponsorship work and how they might make it appear the government is funding something it isn’t.

What’s a Donor-Advised Fund Anyway?

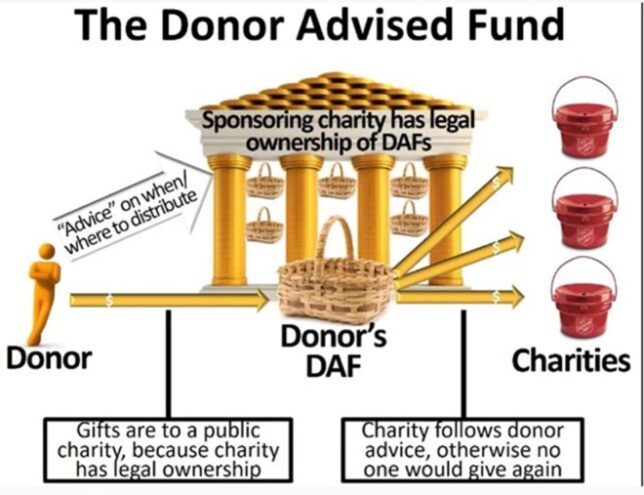

Donor-advised funds (DAFs) are essentially savings accounts pre-dedicated to charitable nonprofit activities, much like college savings plans are pre-dedicated to educational expenses and 401(k) plans are pre-dedicated to retirement income. Unlike those plans, donor-advised funds are not the personal property of the donor-advisor; the account assets are considered “donated” to the charity that provides the donor-advised funds (known as a “donor-advised fund provider” or “sponsoring charity”).

For an individual private donor, donor-advised funds have major benefits versus creating traditional private foundations, which is why many Silicon Valley types have chosen to adopt donor-advised fund accounts for their philanthropies. Contributions to donor-advised funds are deductible to the extent permissible by law at the time of the initial fund donation, not later when the funds are disbursed to the final recipient charity. Unlike private foundations, there is no minimum annual payout for a donor-advised fund. The money can be held and grow in the account as a legal asset to the donor-advised fund provider indefinitely.

For donors interested in controversial or political-advocacy matters, donor-advised grantmaking creates a layer of privacy against public scrutiny, since contributions to a DAF are shown as grants to the sponsoring charity (for instance, the Fidelity Investments Charitable Gift Fund). While grants from a DAF are reported as contributions by the sponsoring charity, that does not reveal the particular donor-advisor who directed the grant to its final destination.

What is most important about DAFs and most relevant to the DOGE analysis is that their grantmaking is explicitly directed by the fund donor. There is not a single pool of grantmaking money for the sponsoring charity to disburse or use at its discretion. Instead, there are many pools, each controlled by its original donor-advisor.

What Are Donor-Advised Fund Providers and Fiscal Sponsors?

The largest donor-advised fund providers are spinoffs from major financial institutions sometimes called “commercial” DAF providers. Fidelity Investments Charitable Gift Fund is the largest public charity in the United States and is a provider of donor-advised funds. Commercial DAF providers usually have no ideological valence, though they have faced left-wing “cancel culture” pressure campaigns from groups like the Southern Poverty Law Center to restrict donor-advisors from directing contributions to certain right-of-center organizations.

Related but not identical to the commercial DAF providers are “community foundations” like the Silicon Valley Community Foundation. Community foundations offer similar services, though they are usually more openly left-leaning (as is SVCF, used by Big Tech megadonors like Mark Zuckerberg).

Other DAF providers are ideological. Among the best-known are the left-of-center Tides Foundation and the right-of-center DonorsTrust. They may offer additional services to ideologically interested donors, including advice on advocacy charities the providers consider worthy of support and security that, if the donor-advisor dies before the fund is exhausted, the donor-advisor’s grantmaking intent will be honored in future contributions from the fund.

Other ideological charities may offer DAFs as part of their services alongside other ideological charitable advocacy. Rockefeller Philanthropy Advisors (RPA) both conducts its own charitable projects and offers donor-advised funds. Closely related to the question of DAFs is the matter of fiscal sponsorships, under which a charity (which may or may not also offer DAFs to donors) takes a number of charitable projects under its tax-exempt umbrella. Because fiscally sponsored projects do not have their own tax-exempt status, grants made to support those projects are reported on tax forms as going to the sponsoring charity. Only sometimes is it disclosed which specific fiscally sponsored project received the money.

The DOGE Connection

So where do the donor-advised fund and fiscal sponsorship issues collide with DOGE’s efforts to scrutinize federal spending? Simple: misunderstanding donor-advised funds or fiscal sponsorships can make it look like the government is funding something it isn’t.

Consider the example that’s currently prominent in DOGE discussions. Concerned citizens saw funds passing from USAID to Rockefeller Philanthropy Advisors. Then, RPA passed funds to the Hopewell Fund. And at the end of the chain, Hopewell Fund passed funds to the network of Republican-in-name-only advocacy groups associated with former Weekly Standard editor and Dan Quayle aide Bill Kristol. Those citizens ask a reasonable question: Did the foreign-aid division of the U.S. federal government fund a domestic political advocacy project?

Probably—indeed, almost assuredly—not, or at least these data cannot sufficiently prove it, and the logic of DAFs and fiscal sponsorships explain why these data cannot.

What Likely Happened

USASpending.gov, the federal government’s public listing of outside expenditures, lists 13 grants to Rockefeller Philanthropy Advisors. The largest USAID grant to RPA was for $20 million (of which about $19.2 million has been spent) “TO A NEW INTERNATIONAL FUND FOR PUBLIC INTEREST MEDIA, A SPONSORED PROJECT OF ROCKEFELLER PHILANTHROPY ADVISORS” (original all-caps).

The International Fund for Public Interest Media, which is a project of Rockefeller Philanthropy Advisors, in turn makes grants to various foreign media outlets. This may be good or bad (it’s probably bad; does anyone trust the U.S. government to make the case for America through its spending on foreign media?), but it is not funding Bill Kristol’s advocacy network. (There is no evidence that any of the other 12 grants went to anything remotely related to Bill Kristol’s advocacy network, either.)

It isn’t even a case of money being fungible, really. Both fiscal sponsors and donor-advised fund providers have multiple “pools” of funds that cannot co-mingle, rather than having one pool of funds that it can draw on or shuffle around like a traditional charitable organization. As a general rule, a DAF provider cannot draw on one donor’s fund to make grants that another donor wants to make, though some have a pool of discretionary money they can distribute as the management of the sponsoring charity sees fit. As a general rule, a fiscal sponsor cannot draw on grants earmarked for one project to support another, and project shortfalls created by fund-expenditure restrictions are harder to cover with a smaller “general fund.”

The goals of the many commentators and citizen investigators who are hard at work trying to expose controversial philanthropic or public grants are worthy of support. Instead, these complexities, which see entire philanthropic structures created as obfuscation vehicles, illustrate just how the nonprofit regulatory structure can serve special interests. It also shows why so many people have lost trust in the government grant process and in Big Philanthropy.

Source: https://capitalresearch.org/article/who-paid-for-that-the-problem-with-analyzing-federal-grants/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.